Another crypto company goes bust

Here’s a list of major cryptocurrency companies that have gone bankrupt since then.

Three Arrows Capital: The crypto hedge fund defaulted on a crypto loan worth more than $650 million soon after the terraUSD-Luna collapse and filed for bankruptcy on July 1, 2022.

Voyager: The US crypto lender filed for bankruptcy just five days after Three Arrows Capital went bust.

Celsuis: The crypto lender filed for bankruptcy on July 14 after falling victim to the terraUSD-Luna collapse.

FTX: The collapse of FTX, the world’s second largest crypto exchange, shocked the world in November. Founder Sam Bankman-Fried was arrested in the Bahamas and extradited to the US after a long delay, during which he went on an ill-advised media tour. Earlier this month he pleaded not guilty to criminal charges.

Genesis: One of the world’s largest crypto lenders, Genesis froze withdrawals in November after the spectacular collapse of FTX.

BlockFi: The crypto lender filed for bankruptcy in late November, a fortnight after FTX collapsed, as it had substantial exposure to the crypto exchange. Another victim of the terraUSD collapse, It had been relying on a $400 million credit facility from FTX to stay solvent after Voyager and Celsius went bankrupt in July.

With inputs from agencies

Top Stories By Our Reporters

The unravelling of GoMechanic

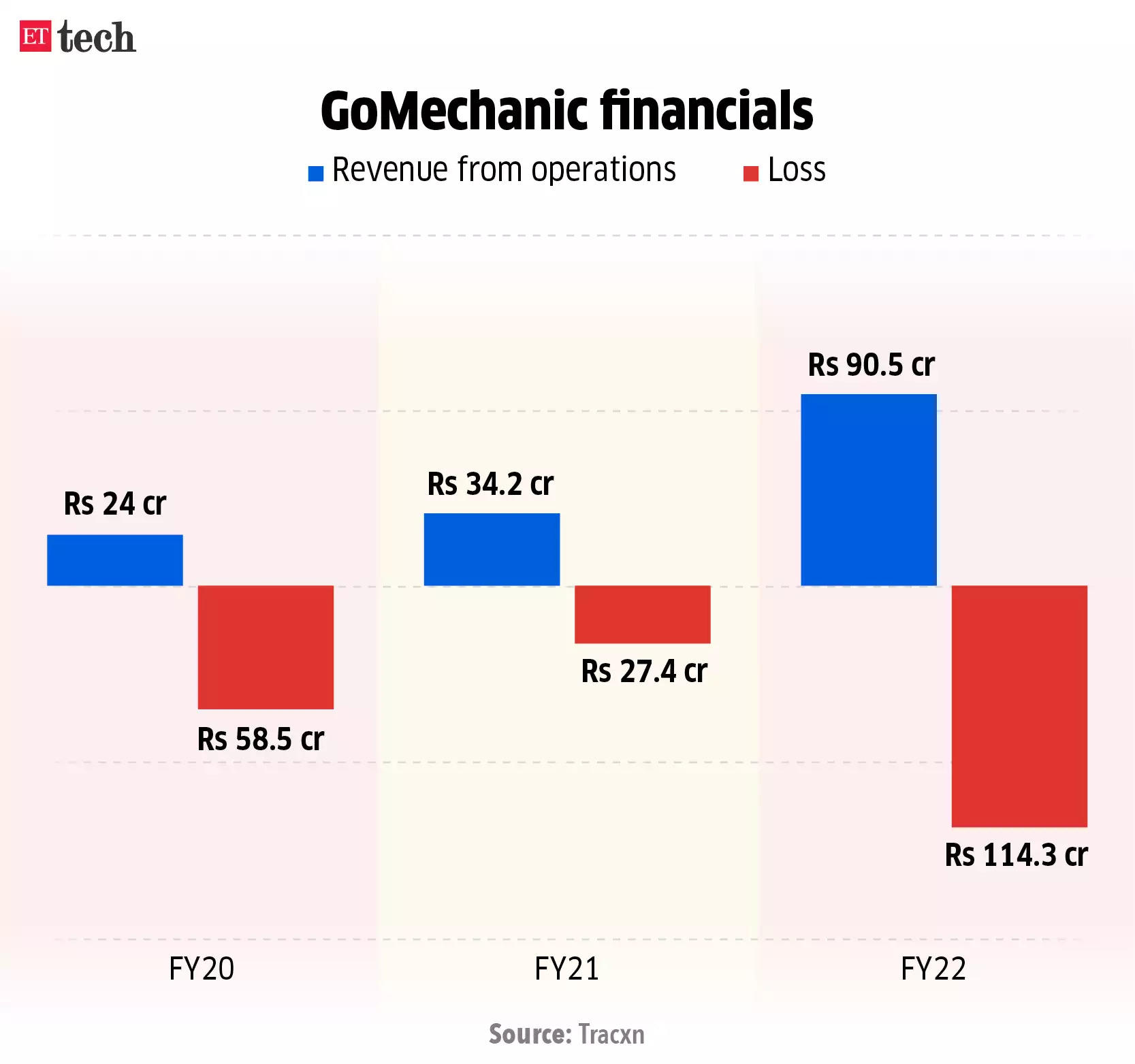

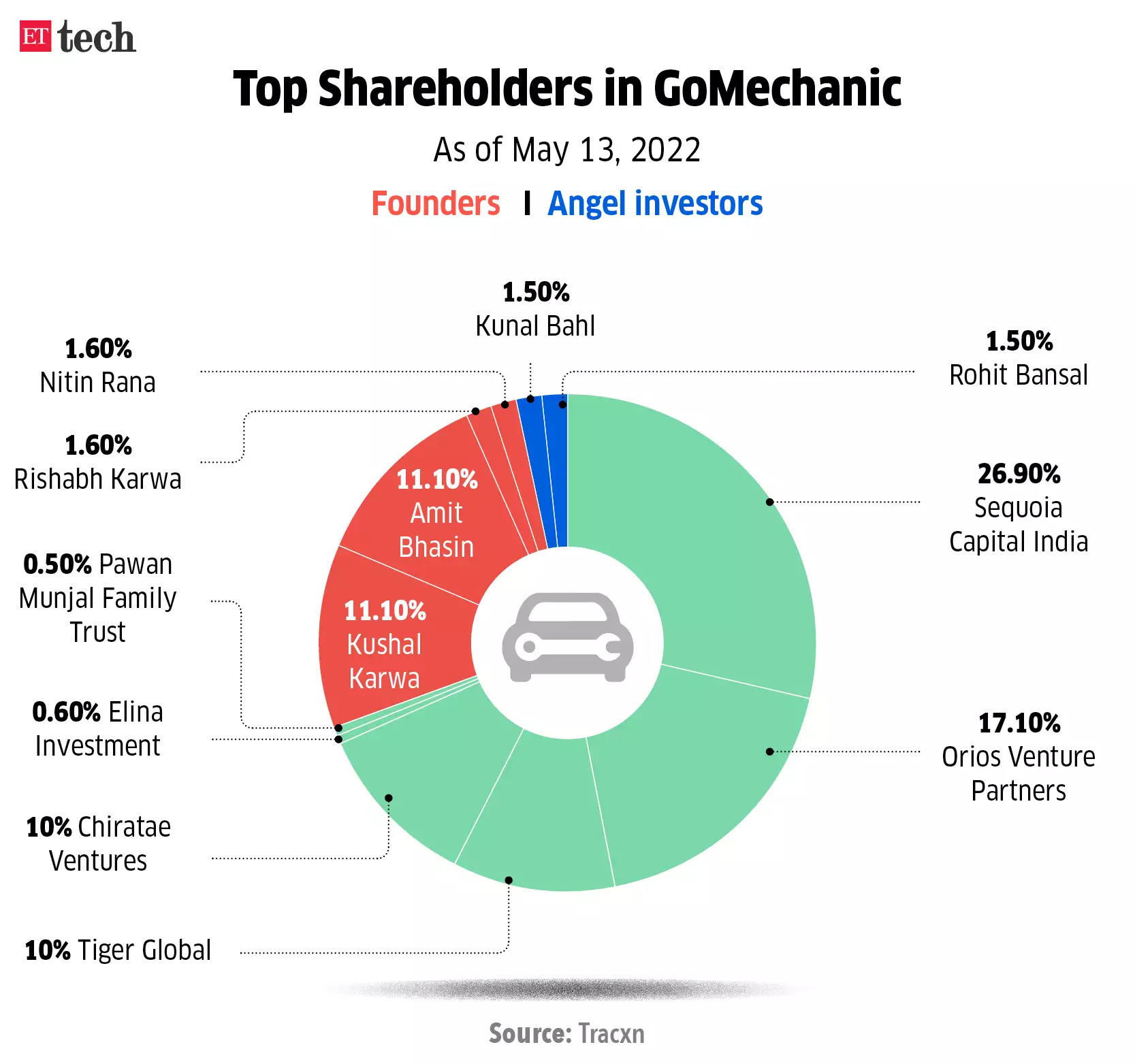

On January 18, one of the founders of car servicing startup GoMechanic, Amit Bhasin, admitted in a LinkedIn post that there had been financial misreporting at the firm. He also said the company was laying off 70% of its employees and the board had initiated a forensic audit of the firm.

ET reported earlier that day that SoftBank and Malaysian sovereign fund Khazanah pulled out from funding GoMechanic after a due diligence (DD) report from EY brought to light glaring loopholes in the company’s financial reporting and overall business.

‘I admit’: Bhasin took to LinkedIn to admit that the founders got “carried away” in their bid “to survive the intrinsic challenges of this sector, and manage capital”. “We made errors in judgement as we followed growth at all costs, including in regard to financial reporting, which we deeply regret,” he wrote.

Discrepancies flagged: Pricewaterhouse, the auditor of GoMechanic in FY20, had flagged discrepancies in how the startup had reported its business activities and assets, regulatory filings reviewed by ET showed.

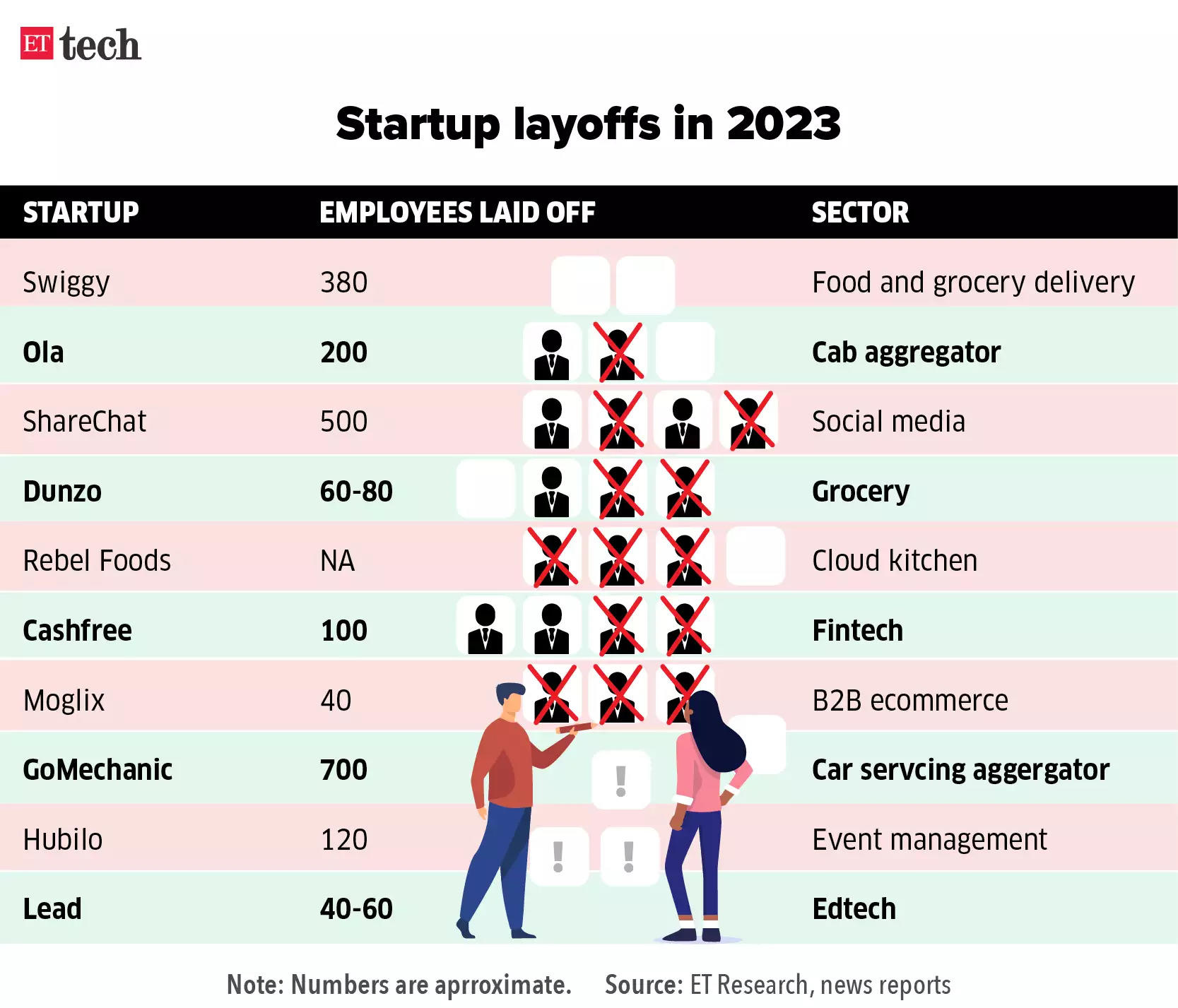

More layoffs in 2023

Google parent Alphabet on January 20 announced that it plans to cut about 12,000 jobs or 6% of its global workforce. The layoffs will affect jobs globally and across the entire company, chief executive officer Sundar Pichai told employees in an email on Friday, writing that he takes “full responsibility for the decisions that led us here”.

Microsoft announced on January 18 that it plans to slash close to 10,000 jobs or nearly 5% of its workforce by the end of the third quarter of fiscal 2023 in an attempt to save $1 billion in costs.

Back home, MohallaTech, the parent firm of vernacular social media platform ShareChat and short-video app Moj, laid off around 20% of its staff or over 500 employees in a fresh round of layoffs.

And Swiggy will sack 380 employees, CEO Sriharsha Majety told employees in an internal note on Friday morning. Majety said the company’s food delivery business has been growing more slowly than expected. He also said that the company overhired over the past two years due to “a case of poor judgement” on his part.

Read the full text of Sriharsha Majety’s email to Swiggy employees here

Meanwhile, virtual and hybrid events platform Hubilo fired about 120 employees, or 35% of its workforce, after witnessing “de-growth” in 2022. This was Hubilo’s second such exercise in less than a year after it reduced 12% of its overall employee count in July 2022.

Also Read: Dunzo, ShareChat, Rebel Foods to conduct layoffs amid funding winter

ET Ecommerce Index

We’ve launched three indices – ET Ecommerce, ET Ecommerce Profitable, and ET Ecommerce Non-Profitable – to track the performance of recently listed tech firms. Here’s how they’ve fared so far.

Tech policy

Supreme Court rejects Google’s plea seeking stay on CCI order: In a setback to Google, the Supreme Court on Thursday refused to stay the Competition Commission of India’s (CCI) October 20 order that asked tech giant to make changes to its Android ecosystem by January 19. However, the apex court granted Google a week’s extension to comply with the CCI’s order. The court said the National Company Law Appellate Tribunal (NCLAT) must rule on Google’s appeal by March 31.

CCI denies copy-paste: The Competition Commission of India on Thursday denied allegations by Google that investigators had “copy-pasted” parts of a European ruling against the US firm for abusing the market dominance of its Android platform.

Tax sops top crypto, gaming firms’ budget demands: A rationalised tax regime tops the list of demands put forth by gaming and cryptocurrency firms ahead of the upcoming budget. The online gaming industry has urged the government to not reduce the current TDS threshold of Rs 10,000, which is reportedly being reviewed by the finance ministry.

Centre open to more than a single self-regulating body for e-gaming: The government is open to the idea of more than one self-regulatory organisation (SRO) being set up for certifying and managing online gaming companies, sources in the know told ET. But this may come with stricter rules regarding the legal responsibilities of SROs, the do’s and don’ts, along with other norms for who can form an SRO.

Also read | Govt extends deadline for feedback on draft gaming rules

Funding news

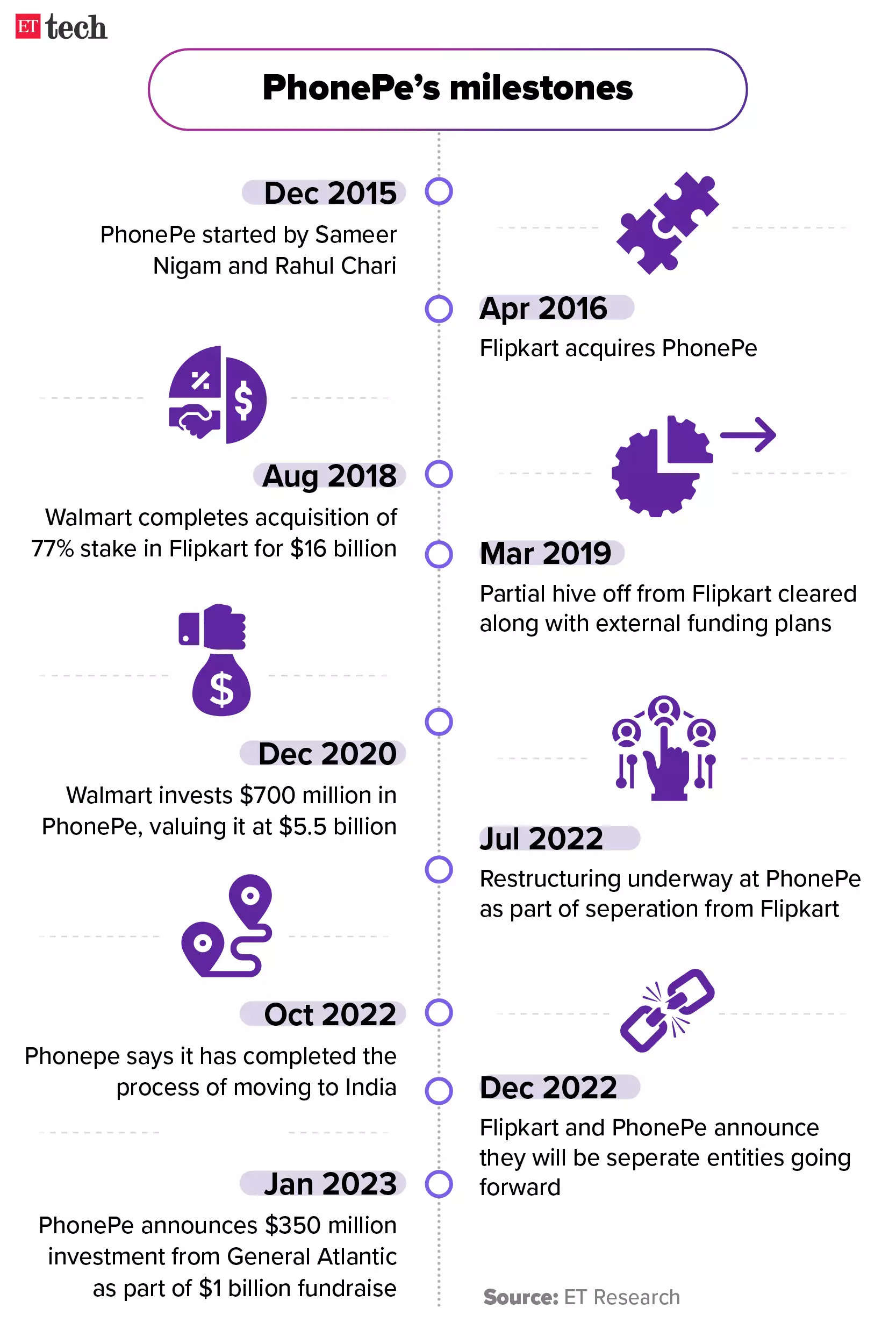

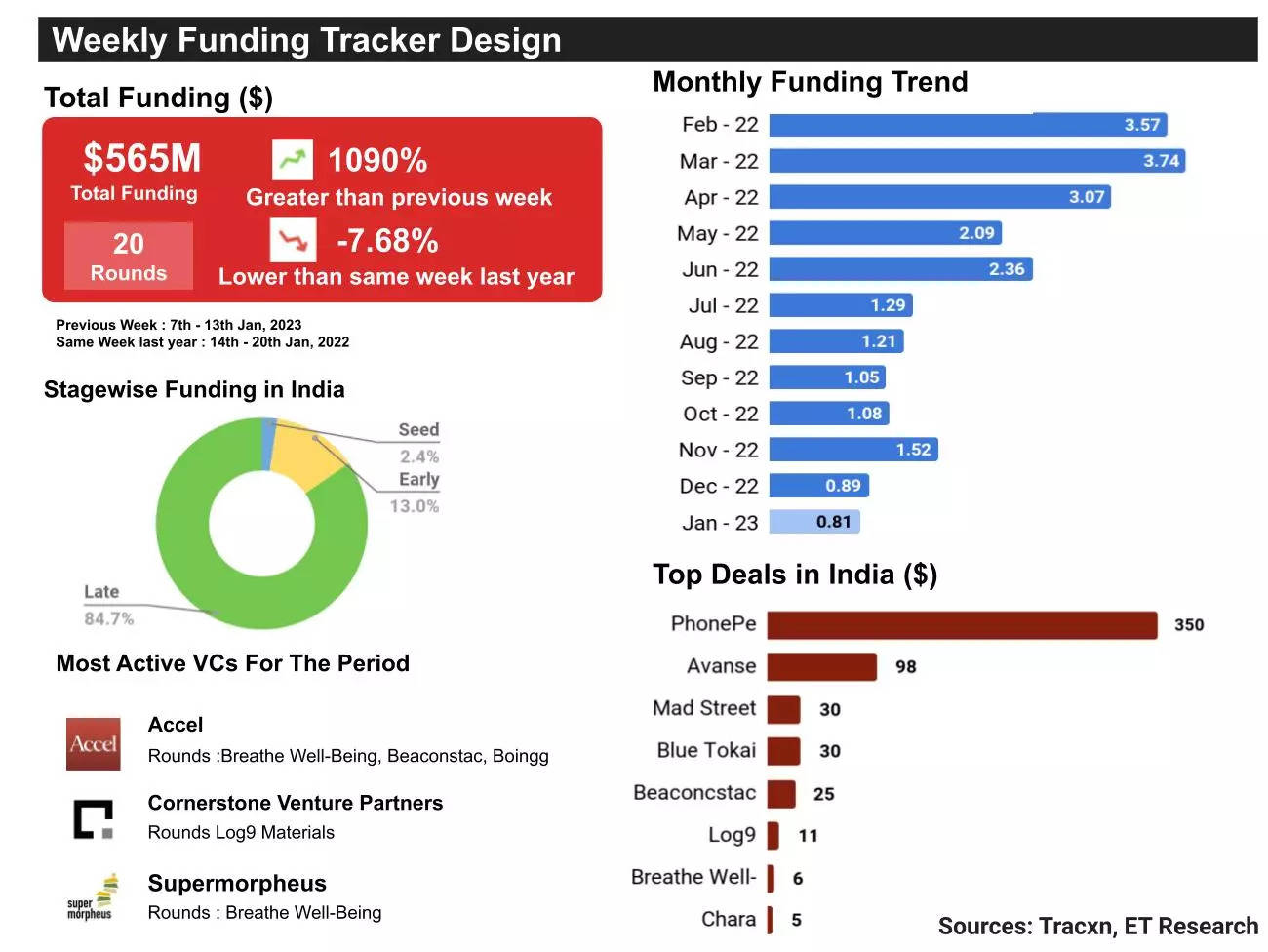

PhonePe raises $350 million in first tranche of $1 billion fundraise: Digital payments major PhonePe said it has raised $350 million in funding from global private equity firm General Atlantic at a pre-money valuation of $12 billion, making it the most valuable privately held Indian fintech firm.

The investment marks the first tranche of an up to $1 billion fundraise that started this month, with other global and Indian investors also participating in the round, the company said.

Coffee company Blue Tokai bags $30 million from A91, others: Specialty coffee brand Blue Tokai Coffee Roasters has raised $30 million (Rs 245 crore) in its latest funding round, led by Mumbai-based investment firm A91 Partners.

Also read | ETtech Deals Digest: PhonePe’s $350 million funding lifts gloom

In other news

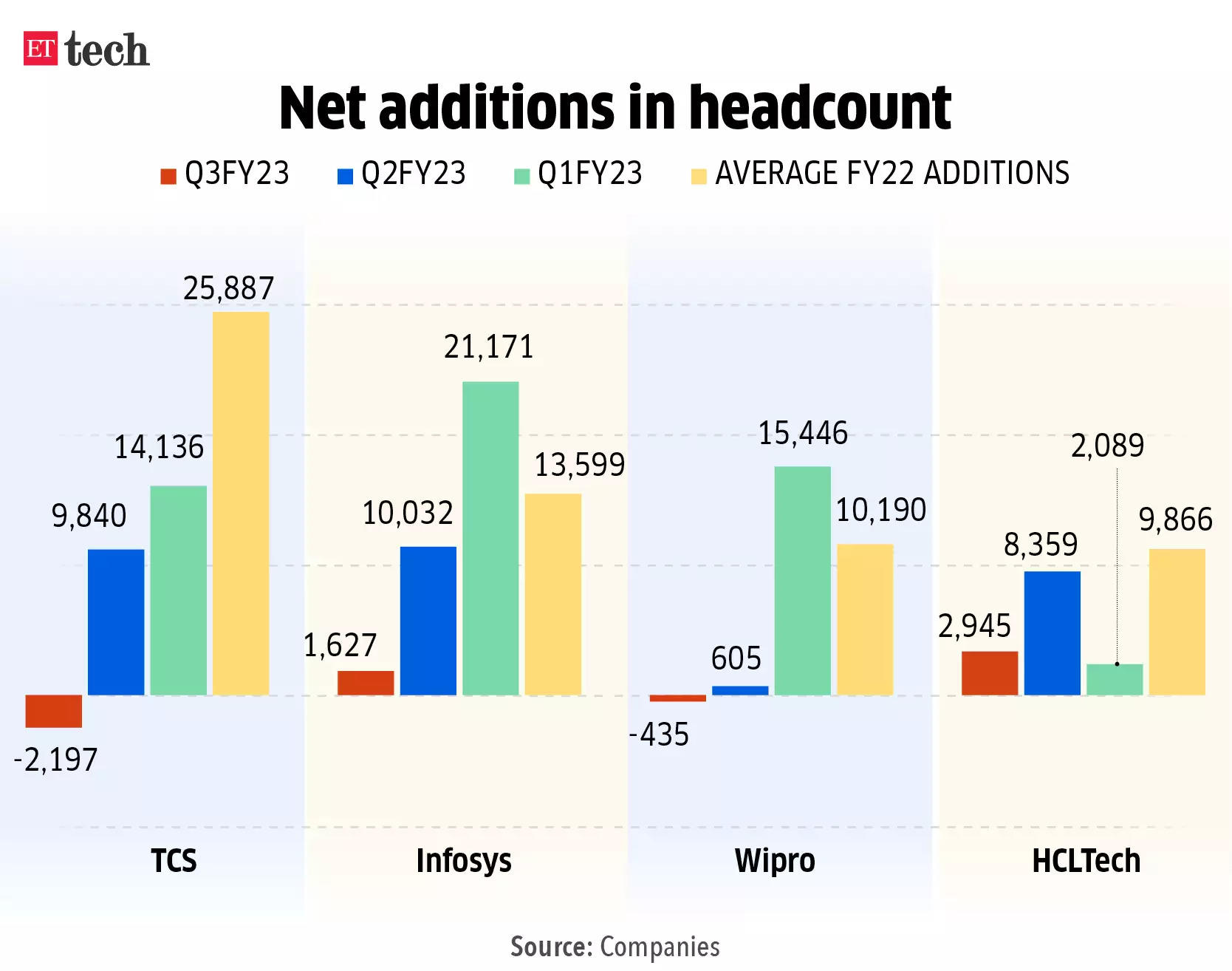

Top four IT firms record sharp drop in net hiring, lowest in 11 quarters: India’s top four software exporters — TCS, Infosys, HCL Tech and Wipro — together recorded a net addition of 1,940 employees in the quarter ended December 2022, the lowest in 11 quarters, as demand for technology services slows amid global macroeconomic uncertainty and geopolitical concerns.

Tata Tech starts work on IPO to raise up to Rs 4,000 crore: Tata group has initiated the process to list Tata Technologies through an initial public offering (IPO). The Tata Motors subsidiary is working with two advisors and is in the process of appointing another, to help it raise Rs 3,500 crore-4,000 crore, valuing it at Rs 16,200 crore–20,000 crore ($2 billion-2.5 billion).

Delhi HC restrains Ashneer Grover from creating ‘interest’ on disputed BharatPe shares: The Delhi High Court on Wednesday restrained BharatPe co-founder and former managing director Ashneer Grover from creating any third-party rights or interest on shares ‘transferred’ to him by the company’s original co-founder Bhavik Koladiya. Koladiya has filed a suit to reclaim the disputed shares, saying Grover has not paid for the shares as per the agreement.

Oyo to refile updated DRHP with Sebi by mid-Feb: Oravel Stays, parent company of Oyo, is planning to refile its public listing application of the draft red herring prospectus (DRHP) with Sebi by the middle of February this year. The company had filed its DRHP for the IPO with Sebi in September 2021 and is aiming to raise Rs 8,430 crore.

Graphics and Illustrations by Rahul Awasthi

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Toncoin

Toncoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Hedera

Hedera  Polkadot

Polkadot  Stellar

Stellar  WETH

WETH  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Uniswap

Uniswap  Pepe

Pepe  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  USDS

USDS  Aptos

Aptos  Internet Computer

Internet Computer  Aave

Aave  POL (ex-MATIC)

POL (ex-MATIC)  Mantle

Mantle  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Render

Render  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  MANTRA

MANTRA  Bittensor

Bittensor  Dai

Dai  Virtuals Protocol

Virtuals Protocol  Arbitrum

Arbitrum

Comments are closed.