Nvidia Stock: Short-Term Pain, Long-Term Gain (NASDAQ:NVDA)

Justin Sullivan

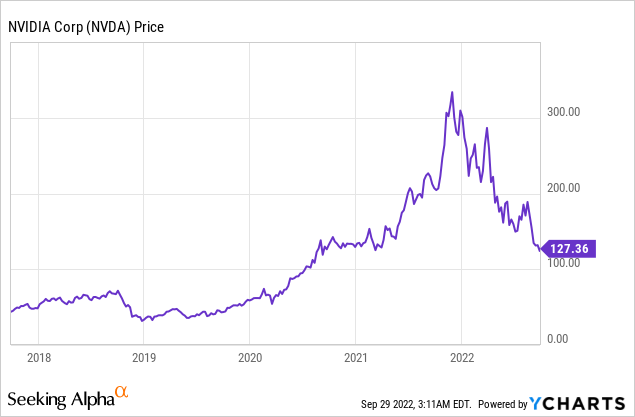

Nvidia (NASDAQ:NVDA) is a global technology company that acts as the backbone for PC gaming, data center, and even the autonomous driving industry. The business’s share price has been decimated and is down by ~61% from its all-time highs in the fourth quarter of 2021. The company announced poor financial results for the second quarter of FY23, which sent the stock price spiraling down further. The good news is Nvidia still beat analyst expectations and I believe the majority of issues the business is facing are cyclical in nature. In the words of Billionaire investor Warren Buffett, ideally, we are looking for a “wonderful company at a wonderful Price”. Usually “wonderful companies” are massively overvalued and thus the only real opportunity to buy them is when they are facing short-term headwinds. In this case, I believe Nvidia is one such company. In this post, I’m going to break down Nvidia’s business tailwinds, its financials and valuation. Let’s dive in.

Financial Breakdown

Gaming Headwinds

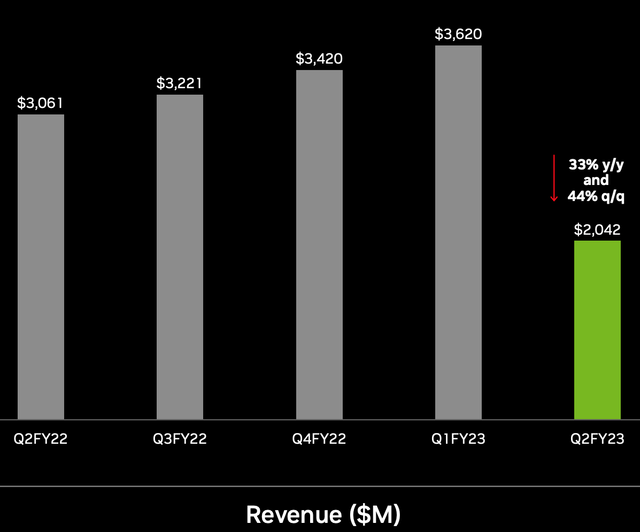

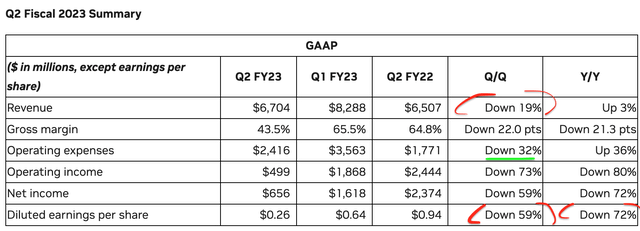

Nvidia reported a mixed earnings report for the second quarter of FY23. Total Revenue was $6.7 billion, which increased by just 3% year over year but plummeted by 19% quarter over quarter. Investors just looking at the top line, may be disgusted by these results from a “growth company” and assume Nvidia’s days are done. However, that would be extremely short-sighted, here’s why. This revenue decline was primarily driven by a 33% decline in Gaming revenue to $2.04 billion. This was further caused by soft consumer demand which was a cyclical correction, after unprecedented positive demand. The gaming industry increased by nearly one quarter in value during 2020 lockdown period, which was its largest growth rate in over 10 years. Thus, we are now simply seeing an overcorrection in demand as Microsoft (MSFT) reported a similar trend with declining gaming revenue from its Xbox.

Gaming Revenue (NVDA Earnings Report Q2,FY23)

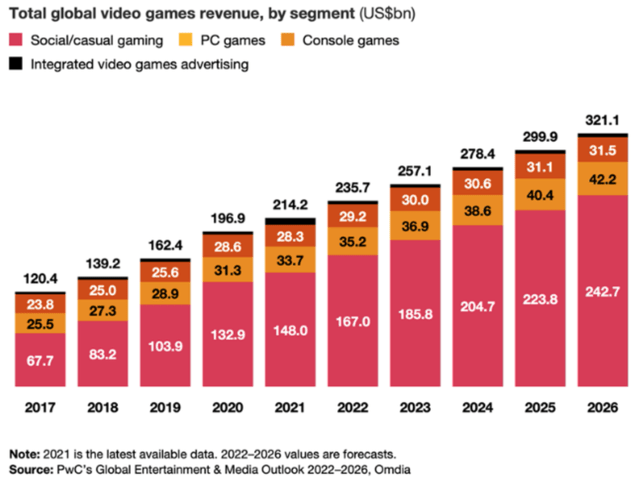

The good news for Nvidia is that despite the decline in gaming revenue, the market trend is still up. The gaming industry is expected to grow at a 9% compounded annual growth rate [CAGR] between 2021 and 2026 and reach $321 billion by the end of the period, according to a PwC study.

Gaming Industry (PwC)

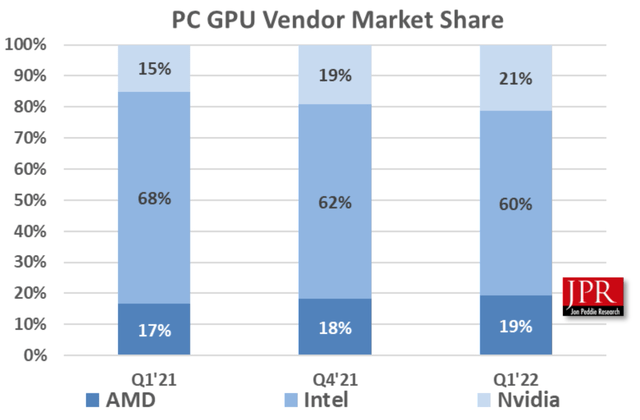

Let’s take a step back to understand Nvidia’s position in the gaming market. Intel (INTC) has the largest market share [~60%] of “standard” GPU’s those that come by default in most low-performance/average PCs. However, Nvidia and AMD (AMD) lead the high-performance graphical processing unit [GPU] industry. Thus, high performance PCs tend to have a standard Intel GPU and an NVIDIA GeForce unit. From the chart below, it is clear to see that Nvidia had 15% of the GPU market share in 2021, but by 2022, the business had 21% market share, eating up a few points from Intel, as AMD also gained share.

GPU Market share (JPR research)

Nvidia and AMD are close competitors with various technical review websites finding it hard to separate the two. One website has AMD, “squeaking” out a small victory over Nvidia. But another review website states;

“Nvidia continues to dominate AMD in the workstation space, and there’s just no way that we could recommend AMD outright for even a single workload we covered.”

Nvidia is also a leader in 4K gaming and ray tracing which models light in a realistic fashion. Nvidia has 80% market share in PC gaming, with 15 of the top 15 most popular GPUs on Steam, according to the company. Nvidia also powers the Nintendo Switch console and has announced a range of gaming laptops and monitors, which vertically integrates the business to a greater degree, by selling more directly to the consumer. In the second quarter, management has implemented “inventory adjustments” and pricing programs to help sell old inventory, which has been left over from the drop in demand. As the gaming industry rebounds and continues its upward growth trend, Nvidia is poised to benefit, despite the market noise right now.

Crypto Catastrophe

The price of Bitcoin has plummeted by approximately 63% from its all-time highs in 2021, which is part of a larger “crypto catastrophe”. This is relevant to Nvidia because many of its GPUs were bought for Bitcoin mining, and the company clumps this together as “gaming revenue”. It is hard to say whether cryptocurrency will bounce back. In addition, many miners are now using ASICs (Application Specific Integrated Circuits) for mining. Then to add insult to injury, in September 2022, Ethereum changed from a power-hungry “proof of work” model to a proof of stake model. Therefore, given these tailwinds, I would deem it less likely for Nvidia’s crypto revenue to rebound, and I will not factor this into my valuation.

Video Editing Trends

Another trend not many people are talking about is the usage of GPUs for professional video editing. The video editing software market is forecasted to grow at a 5.6% CAGR and be worth $3.2 billion by 2030. Now although Nvidia doesn’t make video editing software, it does make the hardware (high performance GPUs) which are the backbone of the video editing industry, which has its growth driven by the creator economy.

As someone who runs a popular YouTube channel [Motivation 2 Invest] where I interview CEOs and hedge fund managers, I have first-hand experience with the hardware required for Video editing. When I originally started my channel, my MacBook pro couldn’t handle the editing and I had to upgrade to a laptop with an Nvidia GPU. Video marketing is also a huge growth industry, as it is often most effective means for customer engagement.

Data Center Delight

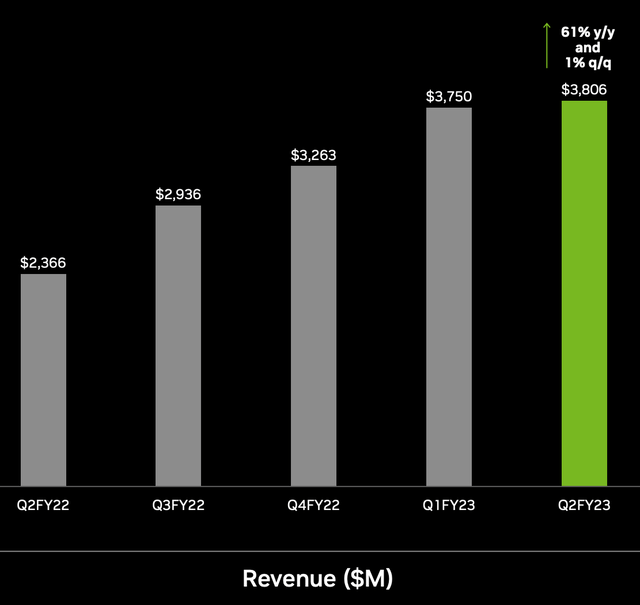

Nvidia’s Data Center segment was the shining light for the company, as demand for the cloud remains robust. The business generated $3.8 billion in revenue for the Data Center segment in the second quarter, which increased by just 1% quarter over quarter but popped by a rapid 61% year over year. According to management, the slower Q/Q growth was mainly driven by supply chain disruptions. But I do suspect IT spending to slow down slightly in the short term given many analysts are forecasting a recession (more on this in the “Risks” section) .

Data Center Revenue (Nvidia)

The good news is the Data Center market is forecasted to expand by a rapid 21.98% CAGR, up until 2026 when $615 billion in value is expected to be added to the market. This growth is driven by number of large organizations who are digitally transforming to the “cloud” which is basically someone else’s data center. Traditionally, businesses kept their IT on-premises, but this often results in high maintenance costs, time wasted, and low flexibility. By transforming the cloud, businesses are effectively taking advantage of “compute of a service”. Nvidia effectively supplies many of the backbone components of these data centers, and its customers include “all major cloud providers” and “hyperscalers” such as AWS (AMZN), Microsoft Azure and Google (GOOG) Cloud. Each of these “big three” hyperscalers have produced tremendous revenue growth in their cloud segments and it is often the fastest growing segment for these organizations. This is great news for Nvidia as it means demand is poised to remain robust, as we have seen during the last quarter. In addition, Nvidia supplies components to Chinese cloud providers such as Alibaba (BABA) and Tencent (OTCPK:TCEHY) cloud, although this may change soon (more on this in the Risks section).

AMD Competition Tailwinds

Not many people know that Nvidia is also an AMD customer, despite being competitors. This is because Nvidia creates servers that are used for Artificial Intelligence and High-performance computing workloads. These often use competitor AMD EPYC CPUs with NVIDIA GPUs. However, Nvidia’s Grace CPU which is being rolled out is poised to replace AMD CPUs which is expected to hit their competitor, right where it hurts. Amazon’s Graviton CPU is also expected to take further market share from AMD. These negative tailwinds against Nvidia’s competitor, AMD, is poised to act as favorable tailwinds for the company and could offer an opportunity for Nvidia to take market share.

The AI industry is also forecasted to grow at a rapid 38% CAGR up until 2030, and Natural Language processing models are also growing. Combined these trends are poised to offer tailwinds behind Nvidia long term.

Automotive Boost

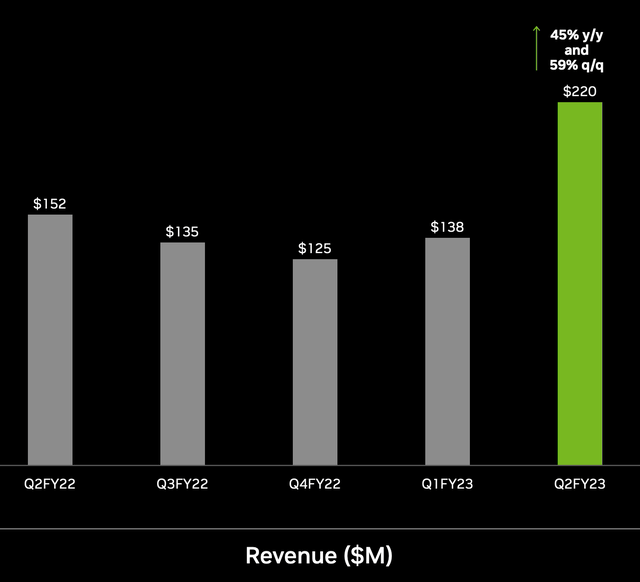

Nvidia’s automotive business segment is also growing strong and increased by 45% year over year to $220 million. This segment has also seen its revenue accelerate quarter over quarter by 59%, which is a positive sign especially given economic headwinds. Nvidia basically offers the backbone technology behind many sensors and self driving vehicle features, via DRIVE Orin. The company has partners/customers which include Mercedes and Jaguar Land Rover. In addition to Chinese EV makers such as NIO, Li Auto and BYD, all of which leverage Nvidia technology for self driving features. Pony.ai is also using Nvidia technology for a fleet of autonomous trucks and robotaxis.

Automotive Revenue growth (Q2 Earnings Presentation)

Metaverse Growth Trend

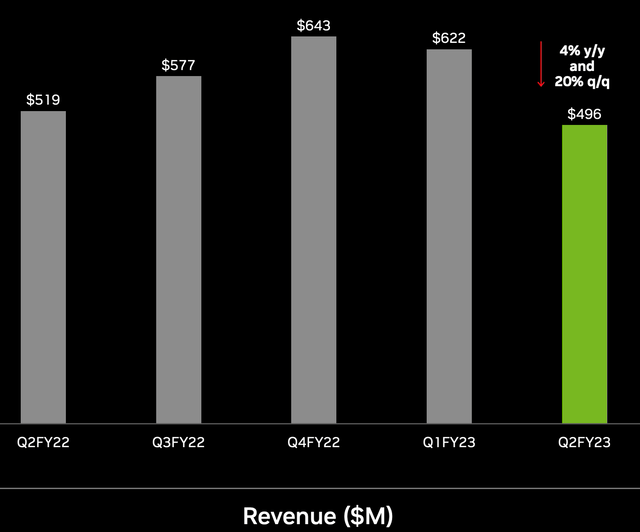

Nvidia is also a market leader in “Professional Visualization”. Revenue for this segment was $496 million, which popped by 20% quarter over quarter, despite being down by 4% year over year. The decline was driven by subdued enterprise demand, but the business did score a key partnership with Siemens to create an “industrial metaverse” based on digital twins. In addition, Nvidia announced its Omniverse Avatar Engine which is a platform for others to build realistic human looking digital assistants. Nvidia hasn’t made the faux pas of changing its name to “Meta” like other companies, but really it wouldn’t be a surprise if they did given they are both a leader in gaming technology and visualization. The Metaverse market is forecasted to grow at a rapid 39.1% CAGR and be worth over $824 billion by 2039.

Professional Visualization (Nvidia Q2 Report)

Profit Margins

Nvidia has historically had a world-class gross margin of over 65%, which did decrease to 43.5% in the second quarter of FY23. However, management believes long term its gross margin profile will rebound. The company saw a 36% increase in operating expenses which wasn’t a great sign, but it was down by 32% quarter over quarter which was a positive. The annual increase was mainly driven by a “one off” expense of $1.35 billion related to the failed acquisition of ARM. The company also increased salaries for its employees and invested aggressively in Research and Development. Overall, I don’t think these are long-term issues and many are actually positives despite the short-term outlook. The good news is Earnings per share was $0.26 in the second quarter, FY23 which was $0.06 greater than analyst consensus expectations.

Profitability (Q2 Earnings Report)

Buyback Boost

Nvidia pays a dividend yield of 0.13%, this may not seem like much but during first half of the fiscal year 2023, the business returned $5.5 billion to shareholders through a combination of dividends and buybacks.

The company also has a robust balance sheet with cash, cash equivalents and short-term investments of $17 billion. In addition, to total debt of $11.7 billion.

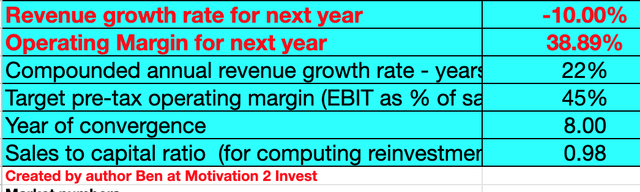

Advanced Valuation

The value of a company is the value of its expected future cash flows, discounted back to today. In this case, I have revised my growth estimates down from previous posts from over 40% to negative 10% growth for next year, driven by gaming decline. However, moving forward, I am forecasting a conservative 22% growth rate over the next 2 to 5 years. I expect this to be driven by further growth in the Data center and even automotive business units.

Nvidia stock valuation 1 (created by author Ben at Motivation 2 Invest)

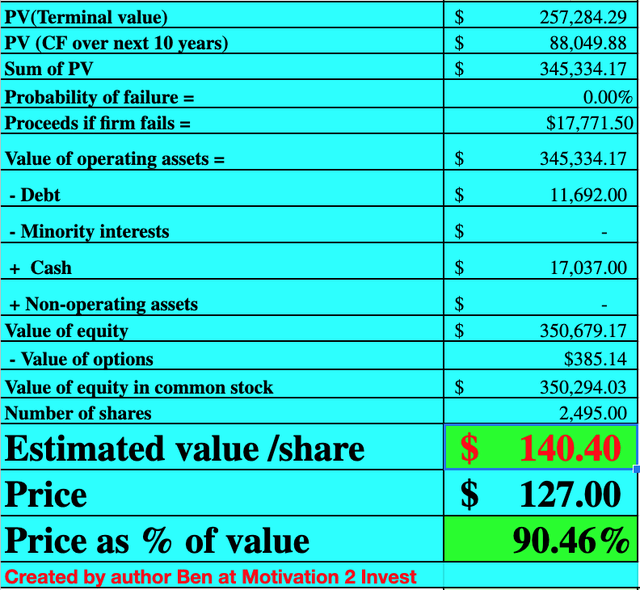

To increase the accuracy of the valuation, I have capitalized the business R&D expenses, which has caused a boost in operating margin. I am then forecasting a recovery in the operating margin to 45% over the next 8 years, as the business recovers from one of expenses and labor cost inflation.

Nvidia stock valuation (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $140 per share, the stock is trading at $127 per share at the time of writing and thus is ~10% undervalued.

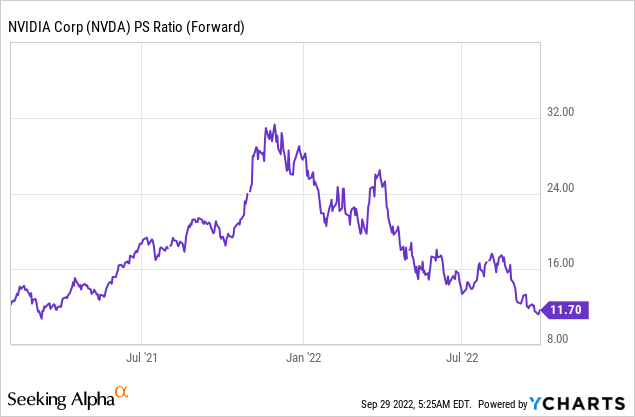

As an extra data point Nvidia is trading at Price to Sales Ratio (FWD) = 11.69, which is 20% cheaper than its five-year average.

Risks

Jim Cramer Short

CNBC pundit Jim Cramer has recently announced he is short Nvidia, due to the Ethereum change I mentioned and the lack of earnings from the AI, VR part of the business. Now although, Jim Cramer has been wrong many times before he does make a few good points for the short term. As a side note, there is an ongoing joke called the “Cramer curse” in the investment community, which states if you did the opposite of Cramer, you would have actually beat the market.

Sales banned China

In the ongoing tensions between the US and China, Nvidia has been caught in the crossfire. The US government issued a notice to Nvidia to stop the sale of A100 and H100 Integrated circuits in China, due to a potential military use by these countries.

Lower IT spend/Recession

The rising interest rate and high inflation environment has caused many analysts to forecast a recession. This may cause businesses to temporarily delay spending on IT for the time being, and has resulted in lower consumer sentiment.

Final Thoughts

Nvidia is a technology powerhouse that is the backbone of the gaming, self driving and data center industries. The business is facing temporary headwinds at the time of writing, but the long-term secular tailwinds remain intact as does Nvidia’s market position. The stock is undervalued intrinsically at the time of writing and thus could be a great investment for the long term.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  XRP

XRP  Dogecoin

Dogecoin  Toncoin

Toncoin  Cardano

Cardano  Shiba Inu

Shiba Inu  Avalanche

Avalanche  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Bitcoin Cash

Bitcoin Cash  Polkadot

Polkadot  Chainlink

Chainlink  NEAR Protocol

NEAR Protocol  Polygon

Polygon  Internet Computer

Internet Computer  Litecoin

Litecoin  Uniswap

Uniswap  LEO Token

LEO Token  Dai

Dai  First Digital USD

First Digital USD  Hedera

Hedera  Stacks

Stacks  Ethereum Classic

Ethereum Classic  Aptos

Aptos  Mantle

Mantle  Cronos

Cronos  Render

Render  Pepe

Pepe  Stellar

Stellar  Filecoin

Filecoin  Cosmos Hub

Cosmos Hub  dogwifhat

dogwifhat  OKB

OKB  Bittensor

Bittensor  Immutable

Immutable  Renzo Restaked ETH

Renzo Restaked ETH  XT.com

XT.com  Arbitrum

Arbitrum  Maker

Maker  The Graph

The Graph  Optimism

Optimism  Wrapped eETH

Wrapped eETH

Comments are closed.