Which Is the Best NFT Marketplace?

OpenSea and Rarible are two of the biggest non-fungible token (NFT) marketplaces. The NFT market is continuously growing, with users from around the globe buying and selling virtual items using their favorite cryptocurrencies.

Both NFT marketplaces have a lot to offer, but what similarities do they share, how do they differ, and which platform is better?

OpenSea Overview

OpenSea is the world’s first and largest decentralized marketplace for NFTs and crypto collectibles. Founded in 2017, the platform quickly rose to prominence for its ease of use, unique NFT listings, and large trading volume.

It currently boasts tens of thousands of active traders with an estimated all-time trading volume of $20 billion. In addition, the platform is home to some of the world’s most notable and high-demand NFT collections, including Crypto Punks, Bored Ape Yacht Club, and more.

OpenSea supports diverse categories of NFTs, including digital collectibles, virtual lands, art, sports assets, music, domain names, and utility NFTs such as membership passes.

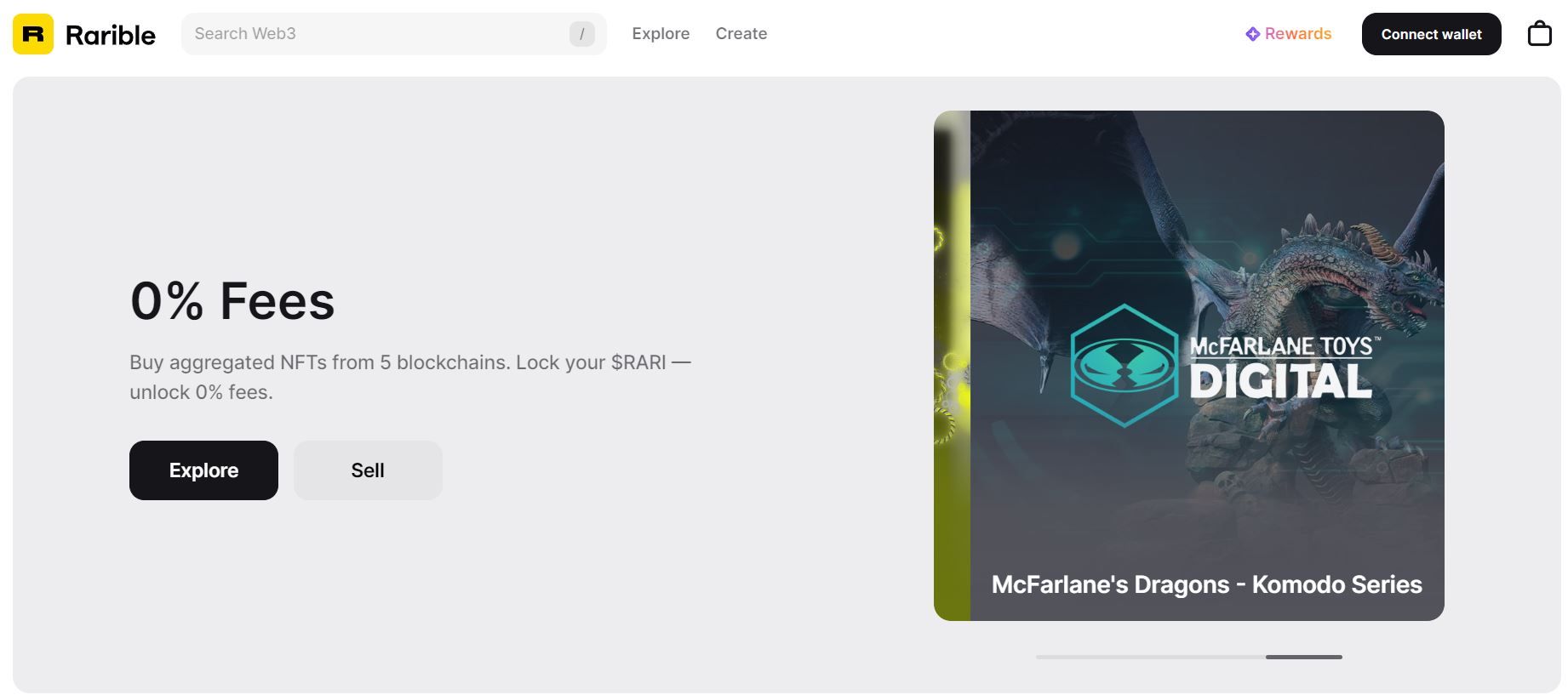

Rarible Overview

Rarible describes itself as “Web3’s first aggregated NFT marketplace.” It is a multi-chain, community-centric marketplace for NFTs and digital collectibles.

Users on Rarible are offered a seamless peer-to-peer interface into the NFT market. The platform is keen on decentralization, with its economy and governance regulated by RARI, its native token.

OpenSea vs. Rarible: Governance

Despite the fact that both platforms operate on the blockchain, their governance structure is quite different.

OpenSea doesn’t operate a decentralized governance model, as its core team, led by Devin Finzer and Alex Atallah, still makes policy decisions for the platform. However, this has led to some questionable decisions being implemented with mixed reactions from the NFT community.

Rarible, on the other hand, does offer decentralized governance through its native token, RARI. Active users on the platform can earn RARI through trading activities. In addition, RARI holders are elevated to stakeholder status, where they can actively contribute to governance decisions, policy changes, and the future of Rarible.

OpenSea vs. Rarible: Payment Options

OpenSea offers users the opportunity to pay for NFTs with support for up to 150 cryptocurrencies, including Ethereum (ETH/WETH), SOL, AVAX, USDC, BNB, and DAI.

Rarible payments are restricted to just ETH, FLOW, XTZ, or MATIC, although the platform has begun to receive payments via credit cards in an attempt to attract mainstream users.

OpenSea vs. Rarible: Trading Fees

Users on both platforms must pay a portion of the money earned from the sale of NFTs as a commission. This is in addition to network fees on the associated blockchain.

OpenSea receives 2.5% of the sale price, while Rarible takes 1% each from the buyer and seller for every sale on their marketplace.

Royalty fees for NFT creators also differ. OpenSea’s royalty fee is fixed at 10%. In contrast, Rarible provides creators the opportunity to receive up to 50% in royalty fees.

OpenSea vs. Rarible: Gasless Minting

Gasless minting, also known as lazy minting, affords digital creators the opportunity to mint NFTs without paying network fees. However, remember that all transactions on blockchains attract a network fee that is paid to the network validators responsible for providing the infrastructure for activities on the blockchain.

Gasless minting allows the creator to automatically transfer the responsibility of paying minting fees to the buyer of the NFT or digital collectible. OpenSea and Rarible both have gasless minting enabled on their platforms.

OpenSea vs. Rarible: Security

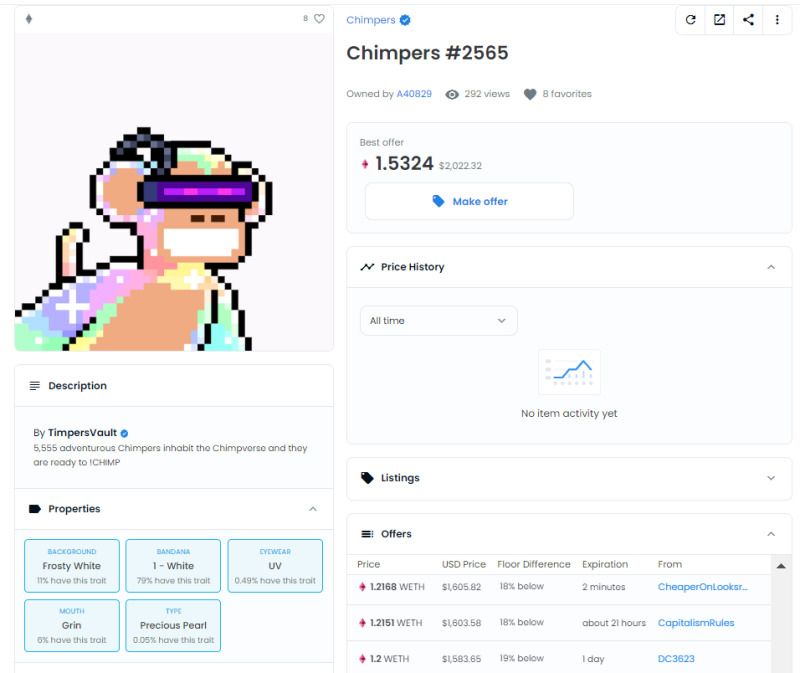

A key talking point when interacting with digital assets is security. Both platforms follow the standard blockchain procedures for security, but this hasn’t prevented them from exposure to copyright and fraud-related issues.

OpenSea and Rarible use the ERC-721 and ERC-1155 Ethereum standards for NFTs to verify ownership of digital assets to avoid copyright claims. However, due to their operation as open marketplaces, it is difficult to 100% guarantee the authenticity and copyright claims associated with every NFT or digital collectible traded on their platforms.

Recently, OpenSea has had more security incidents, with the latest being a smart contract exploit that left users prone to NFT theft.

OpenSea vs. Rarible: Ease of Use

Both platforms offer a beginner-friendly interface that makes navigating NFTs and digital collectibles easy. OpenSea and Rarible have multi-chain integrations, so users can explore the NFT ecosystems of multiple blockchains.

OpenSea and Rarible possess strength in simplifying the delicate processes involved in managing and monetizing NFTs. There is no need to know how to code before you can create NFTs or any technical specifications for using their trading interfaces.

Both platforms are non-custodial. NFTs are not stored on either platform; instead, they serve as gateways for buying, selling, and minting NFTs. The actual NFTs are stored in the user’s wallet.

OpenSea vs. Rarible: Supported Blockchains

OpenSea offers a wide range of cross-blockchain compatibility across several blockchains. Supported blockchains currently include Ethereum, Solana, Polygon, Avalanche, BNB, Klaytn, Arbitrum, and Optimism.

Rarible, on the other hand, supports creators and collectors on Ethereum, Flow, Tezos, Polygon, Solana, and Immutable X blockchains.

OpenSea vs. Rarible: Pros and Cons

OpenSea and Rarible have quite a number of similarities, but a few features stand each platform out.

Pros of OpenSea

- The platform’s user interface is beginner-friendly.

- OpenSea supports payment in up to 150 different cryptocurrencies.

- It currently supports eight blockchains.

- The platform is home to the largest and most diverse collection of NFT projects.

- Gasless minting is available.

- Available on mobile devices (iOS and Android)

Cons of OpenSea

- The royalty fee is capped at 10%.

- No decentralized governance system.

- Known issues with fraud and platform hacks.

Pros of Rarible

- It is a multi-chain platform with support for five blockchains.

- Rarible allows payment via credit card.

- The platform has an established decentralized governance system powered by its native token ($RARI).

- Easy to use features.

- A flexible royalty fee for creators with a maximum of up to 50%.

Cons of Rarible

- Supports payment in only five cryptocurrencies.

- Not available on mobile devices.

NFT Marketplaces Offer Users More Choices

Depending on your need, the “better” marketplace comes down to personal choice. For instance, digital creators might prefer Rarible to OpenSea because of the larger royalty fee, although OpenSea has a larger marketplace that can make NFT sales happen faster.

Ultimately, it’s all about what is important to you in terms of functionality, payment options, trading fees, and supported blockchains, as both platforms provide similar services. One thing is certain; both platforms are helping to drive mainstream adoption of NFTs and digital collectibles.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  XRP

XRP  Dogecoin

Dogecoin  Toncoin

Toncoin  Cardano

Cardano  Shiba Inu

Shiba Inu  Avalanche

Avalanche  Wrapped Bitcoin

Wrapped Bitcoin  Bitcoin Cash

Bitcoin Cash  TRON

TRON  Polkadot

Polkadot  Chainlink

Chainlink  Internet Computer

Internet Computer  Polygon

Polygon  Litecoin

Litecoin  NEAR Protocol

NEAR Protocol  Uniswap

Uniswap  LEO Token

LEO Token  Dai

Dai  Aptos

Aptos  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Stacks

Stacks  First Digital USD

First Digital USD  Filecoin

Filecoin  Cronos

Cronos  OKB

OKB  Stellar

Stellar  Cosmos Hub

Cosmos Hub  Render

Render  Renzo Restaked ETH

Renzo Restaked ETH  Arbitrum

Arbitrum  Immutable

Immutable  Bittensor

Bittensor  Hedera

Hedera  Maker

Maker  dogwifhat

dogwifhat  The Graph

The Graph  Injective

Injective  Optimism

Optimism  Ethena USDe

Ethena USDe  Fetch.ai

Fetch.ai

Comments are closed.